All Categories

Featured

Table of Contents

RealtyMogul's minimum is $1,000. The rest of their business actual estate offers are for recognized financiers only. Here is a detailed RealtyMogul introduction. If you desire broader property direct exposure, then you can take into consideration getting an openly traded REIT. VNQ by Vanguard is among the biggest and well understood REITs.

Their number one holding is the Vanguard Real Estate II Index Fund, which is itself a mutual fund that holds a selection of REITs. There are other REITs like O and OHI which I am a veteran shareholder of.

To be an recognized financier, you need to have $200,000 in yearly income ($300,000 for joint financiers) for the last two years with the assumption that you'll make the same or extra this year. You can also be considered an accredited financier if you have a total assets over $1,000,000, separately or jointly, excluding their key house.

How do I apply for Passive Real Estate Income For Accredited Investors?

These bargains are frequently called exclusive placements and they do not need to sign up with the SEC, so they don't offer as much information as you would certainly anticipate from, claim, a publicly traded firm. The accredited investor requirement presumes that a person who is certified can do the due persistance on their own.

You just self-accredit based upon your word. The SEC has likewise expanded the definition of recognized financier, making it simpler for more individuals to certify. I'm bullish on the heartland of America offer then reduced valuations and much higher cap prices. I assume there will be continued migration far from high expense of living cities to the heartland cities as a result of cost and innovation.

It's all about following the money. In addition to Fundrise, likewise check out CrowdStreet if you are a recognized financier. CrowdStreet is my preferred system for recognized financiers due to the fact that they concentrate on arising 18-hour cities with reduced evaluations and faster population development. Both are totally free to register and explore.

Below is my actual estate crowdfunding control panel. Sam functioned in investing banking for 13 years.

He hangs around playing tennis and taking care of his household. Financial Samurai was started in 2009 and is just one of one of the most relied on personal financing websites on the internet with over 1.5 million pageviews a month.

With the United state actual estate market on the rise, financiers are sorting with every available property type to uncover which will certainly help them earnings. Which sectors and properties are the ideal steps for investors today?

How do I exit my Passive Real Estate Income For Accredited Investors investment?

Each of these types will certainly come with distinct advantages and disadvantages that investors should review. Let's check out each of the options readily available: Residential Real Estate Commercial Realty Raw Land & New Construction Property Investment Company (REITs) Crowdfunding Systems Register to attend a FREE online genuine estate class and discover just how to get going purchasing actual estate.

Various other household properties include duplexes, multifamily homes, and trip homes. Residential property is optimal for several investors since it can be less complicated to turn revenues regularly. Naturally, there are numerous residential realty investing methods to release and various degrees of competitors across markets what may be appropriate for one investor might not be best for the next.

How do I get started with Accredited Investor Real Estate Investment Groups?

The finest commercial residential or commercial properties to spend in include industrial, workplace, retail, friendliness, and multifamily jobs. For capitalists with a strong focus on enhancing their regional areas, commercial property investing can support that focus (Accredited Investor Real Estate Deals). One reason commercial properties are considered among the best sorts of realty investments is the potential for greater capital

For more information concerning getting begun in , be sure to review this post. Raw land investing and brand-new construction stand for 2 kinds of genuine estate financial investments that can diversify an investor's profile. Raw land refers to any uninhabited land available for purchase and is most appealing in markets with high predicted development.

Investing in new construction is also popular in quickly growing markets. While numerous investors may be unknown with raw land and new building and construction investing, these financial investment kinds can represent appealing earnings for financiers. Whether you have an interest in developing a residential or commercial property from beginning to end or benefiting from a long-lasting buy and hold, raw land and new building give an one-of-a-kind chance to real estate investors.

What should I look for in a Real Estate Syndication For Accredited Investors opportunity?

This will certainly guarantee you pick a preferable location and avoid the investment from being obstructed by market variables. Genuine estate investment counts on or REITs are firms that have different business real estate kinds, such as resorts, shops, offices, shopping centers, or dining establishments. You can purchase shares of these property companies on the stock market.

It is a need for REITs to return 90% of their gross income to investors annually. This provides capitalists to obtain dividends while expanding their profile at the exact same time. Openly traded REITs additionally offer adaptable liquidity as opposed to other kinds of actual estate investments. You can offer your shares of the firm on the stock exchange when you require emergency situation funds.

While this supplies the simplicity of finding assets to investors, this kind of genuine estate investment additionally presents a high amount of risk. Crowdfunding platforms are generally limited to approved capitalists or those with a high net worth.

What should I know before investing in Accredited Investor Real Estate Platforms?

[Learning exactly how to purchase realty doesn't have to be tough! Our online property investing course has every little thing you require to shorten the knowing curve and start investing in realty in your location.] The ideal kind of property financial investment will certainly rely on your individual situations, objectives, market area, and favored investing technique.

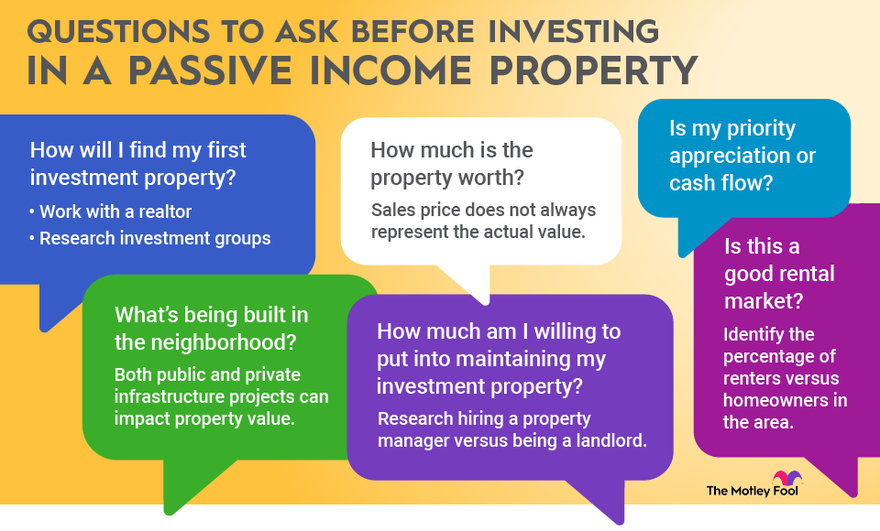

Selecting the right residential property kind comes down to weighing each alternative's advantages and disadvantages, though there are a couple of vital aspects investors must bear in mind as they look for the ideal selection. When choosing the very best kind of financial investment home, the value of location can not be underrated. Capitalists operating in "promising" markets may discover success with uninhabited land or brand-new building, while capitalists operating in more "fully grown" markets might want property properties.

Analyze your recommended level of involvement, danger tolerance, and profitability as you decide which residential property type to purchase. Capitalists wanting to tackle a more passive role might select buy and hold business or homes and employ a building supervisor. Those intending to tackle an extra active role, on the other hand, may discover developing uninhabited land or rehabbing property homes to be a lot more meeting.

Table of Contents

Latest Posts

Delinquent Properties Near Me

Tax Sale Properties List

Surplus Monies

More

Latest Posts

Delinquent Properties Near Me

Tax Sale Properties List

Surplus Monies